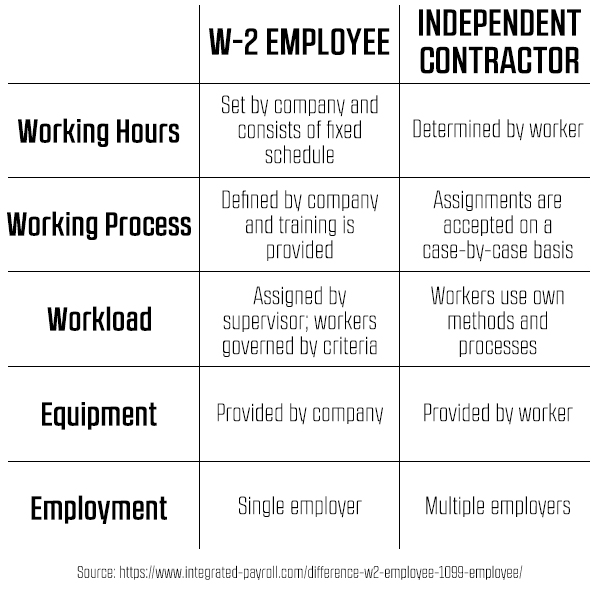

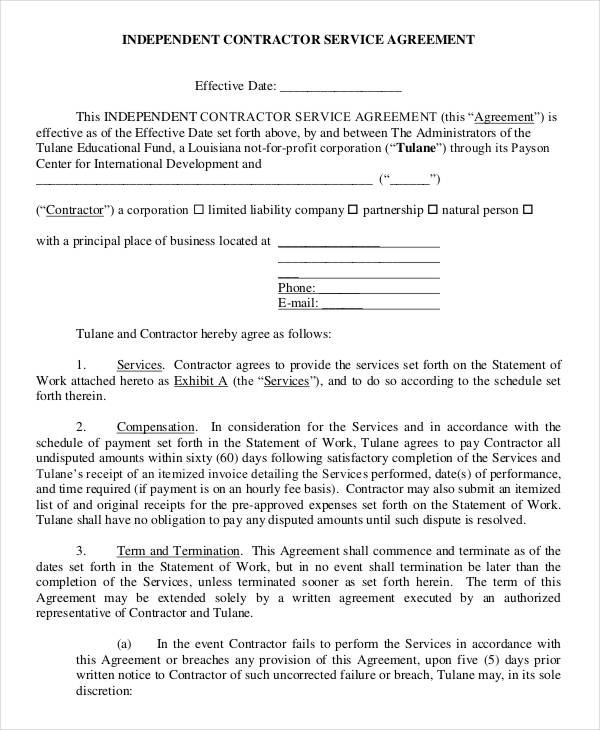

The independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state lawsSample 2 Independent Contractor Indemnification The parties understand and agree that this Agreement is not a contract of employment in the sense that the relation of master and servant exists between District and Republic or between District and any employee of Republic Republic shall, at all times, be deemed to be an independent contractorIf your company decides to hire an independent contractor, having a written contract is mandatory for bookkeeping and tax purposes Unlike an employment contract, the independent contractor agreement needs to specify the services or projects the worker is doing for you and the duration, deadline, and desired outcome of such services

Http Www Giftedtravelnetwork Com Gtn Registration Paperwork Pdf

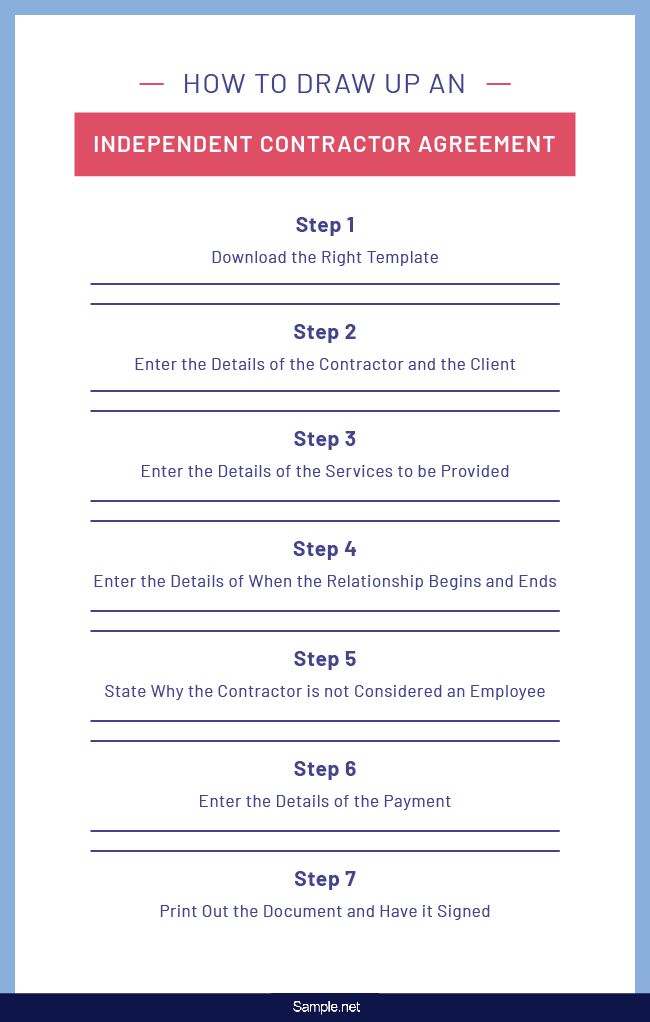

What should be included in an independent contractor agreement

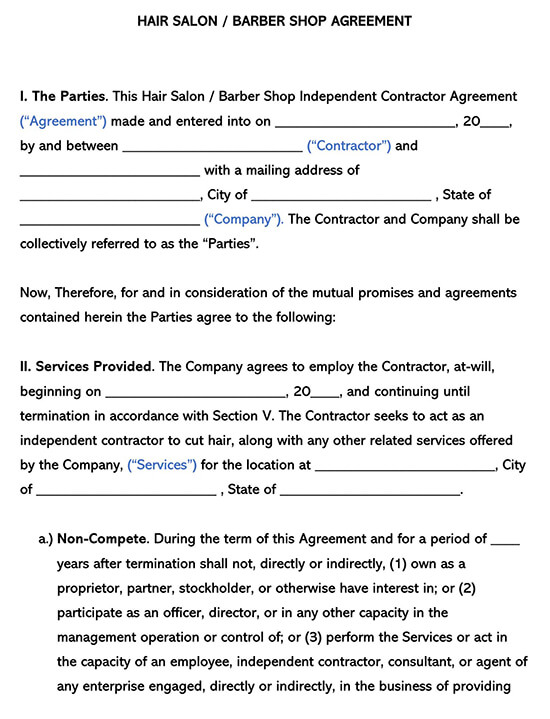

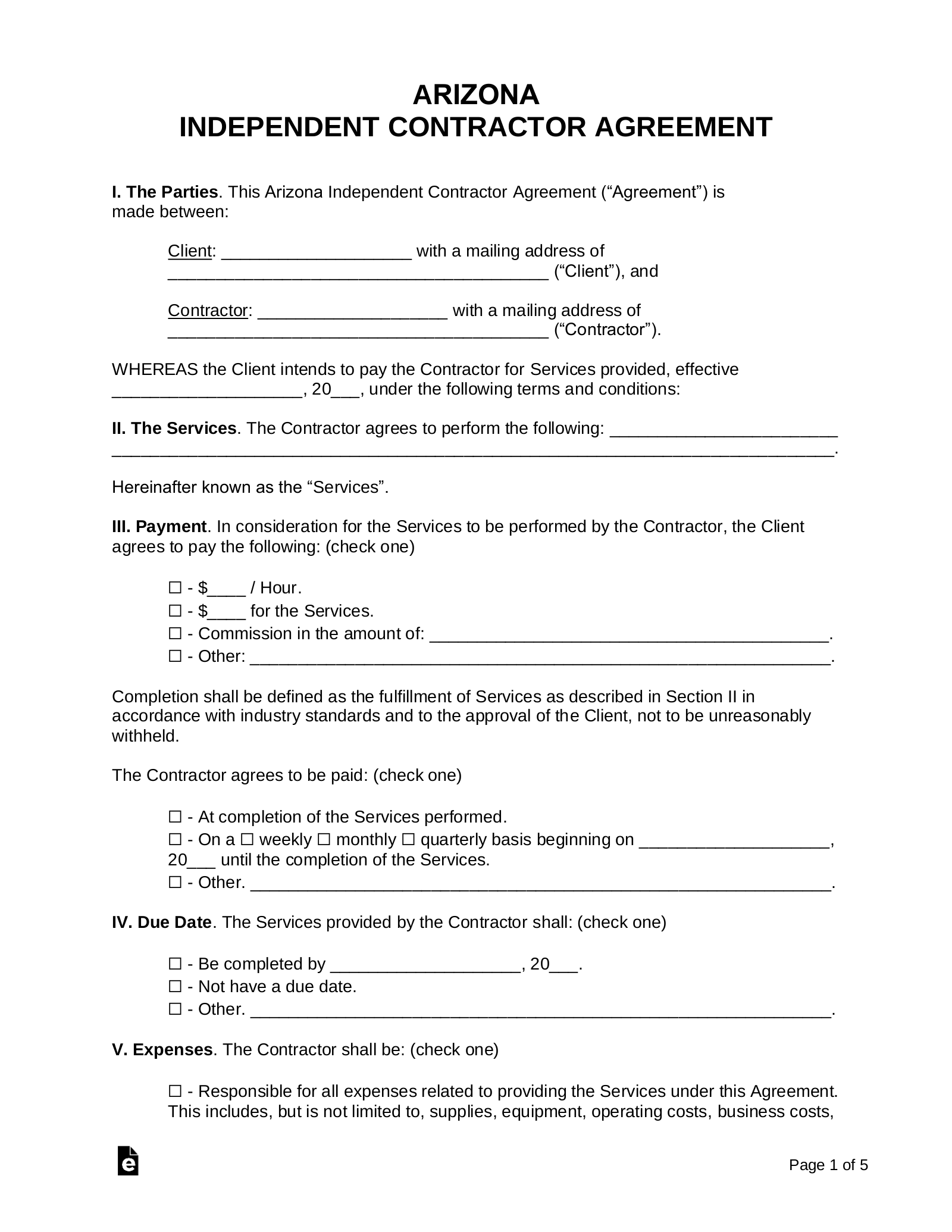

What should be included in an independent contractor agreement-Independent Contractor Agreements are simple to make and are a way of clearly outlining the scope of the work, payment schedules and deadline expectations of a freelance arrangement Our templates also include a confidentiality agreement, insurance expectations andThe California independent contractor agreement is used to define a client's expectations when employing the services of an individual working independently to fulfill a duty The client is able to specify the services they require as well as the designated wage, completion date, termination procedures, and other matters which help establish the working relationship between both parties It is important to note that improperly classifying a worker as an "independent contractor

What Is A 1099 Contractor With Pictures

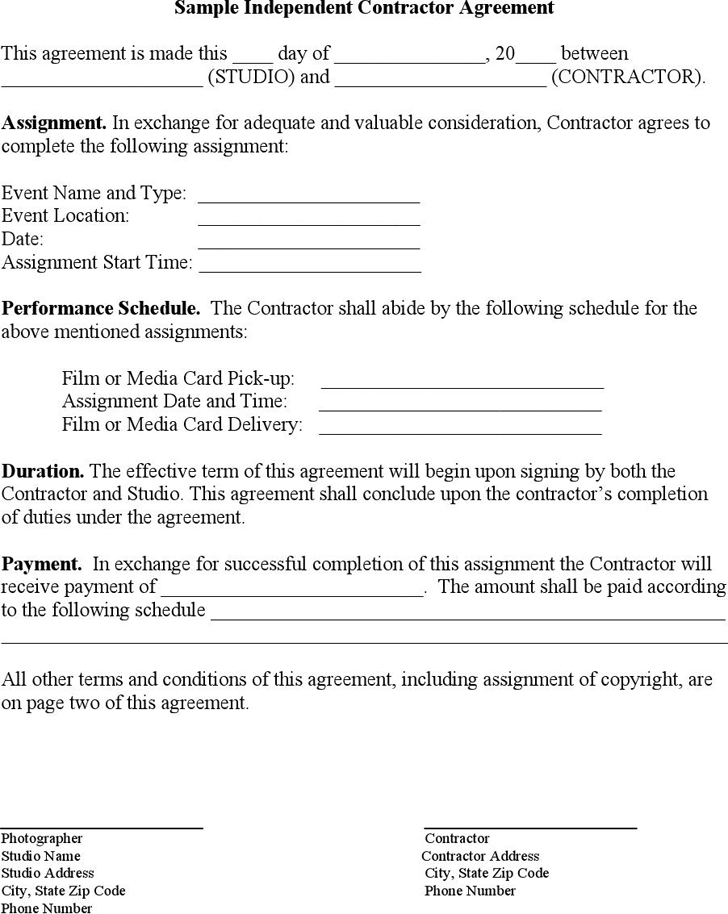

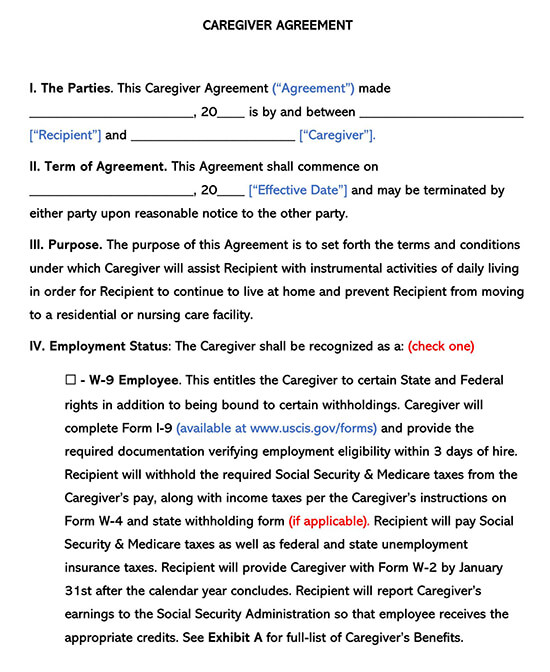

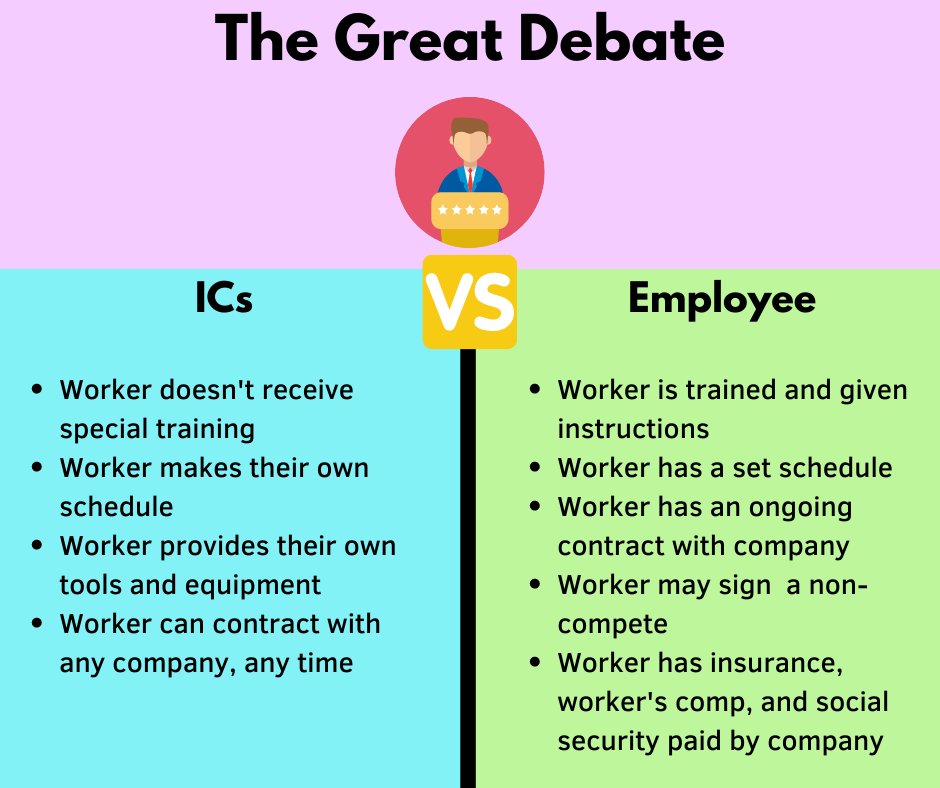

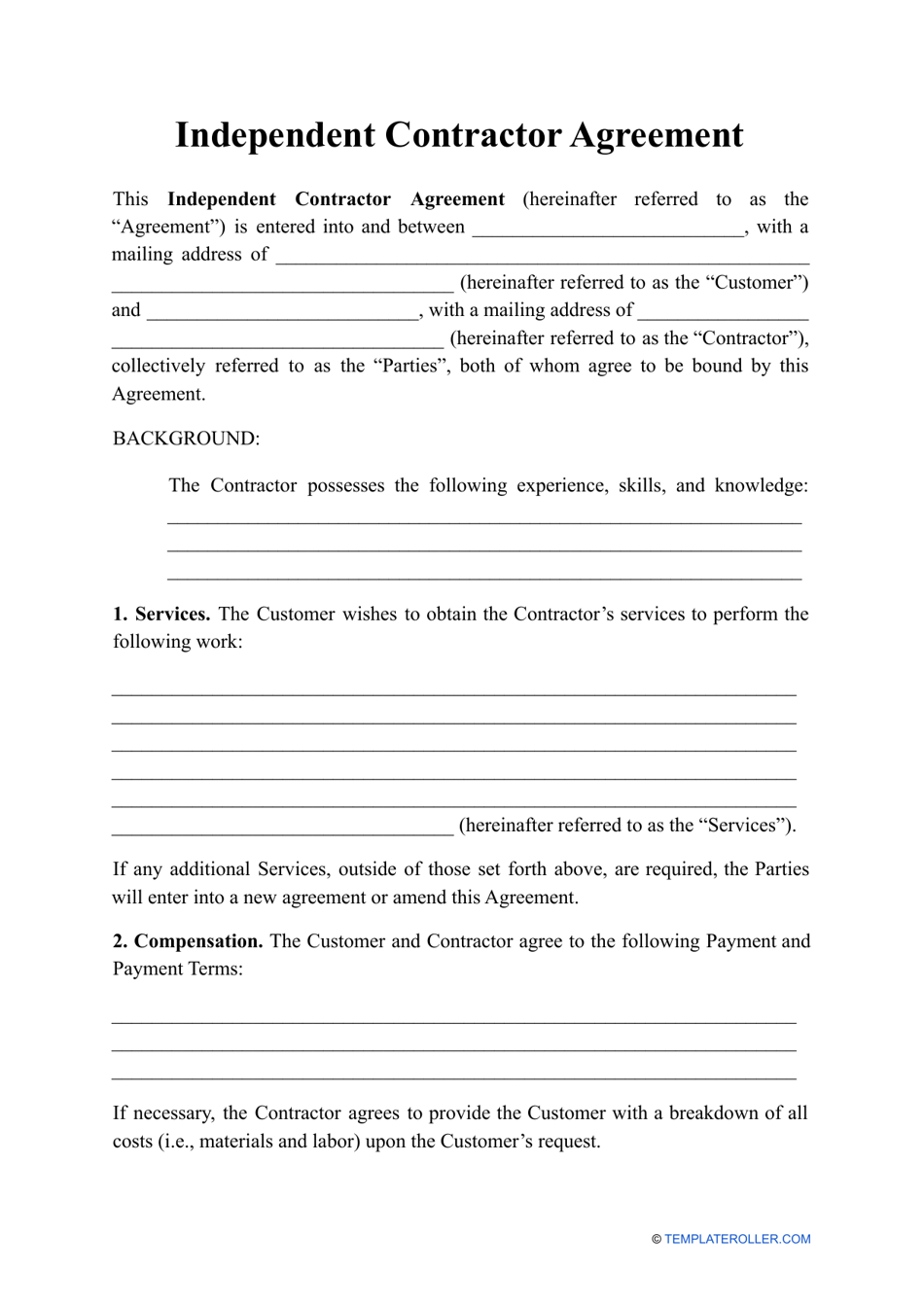

An independent contractor agreement, also known as a '1099 agreement', is a contract between a client willing to pay for the performance of services by a contractorIn accordance with the Internal Revenue Service (IRS), an independent contractor is not an employee and, therefore, the client will not be responsible for tax withholdingsAn independent contractor agreement is a legally binding, written agreement that details the contractor relationship the business relationship between a payer/hiring company and an independent contractor; An independent contractor is a selfemployed professional who works under contract for an individual or business, their client Unlike an employee, an independent contractor cannot be managed by the employer except within the context of their agreement In other words, the contractor makes their own hours and decides how to carry out their services Due to their independent status, contractors

It is a crucial document for tax purposes The provisions of this agreement with an independent contractor should include the following sections Download 10 Free Independent Contractor Agreement Templates to help yourself in preparing Independent Contractor Agreement You can also explore Services Contract Templates to see more options An Independent Contractor is a person who runs his own business and provides services to other individuals and companies without working directly forA simple agreement between a company and an independent contractor, independent contractor agreement is usually used when a company or an individual is hired to a short term task or a specific project Generally, the following things are revealed by a simple independent contractor agreement Who is being hired and by whom

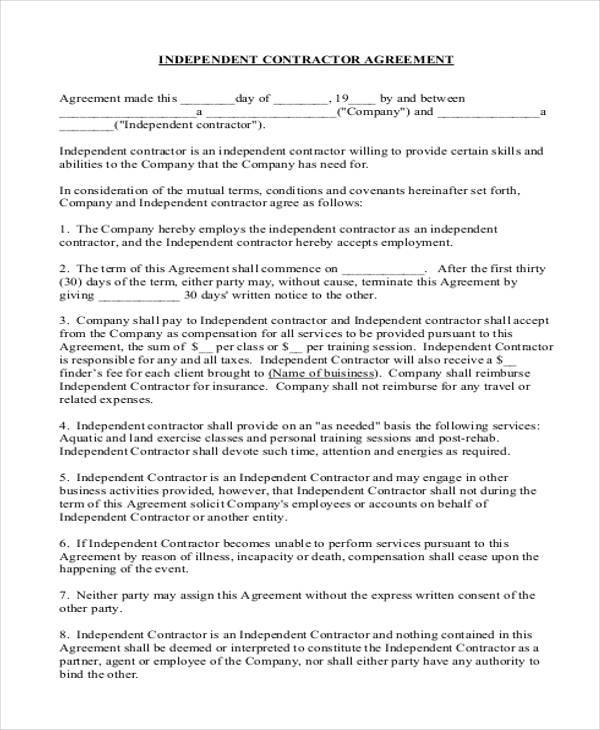

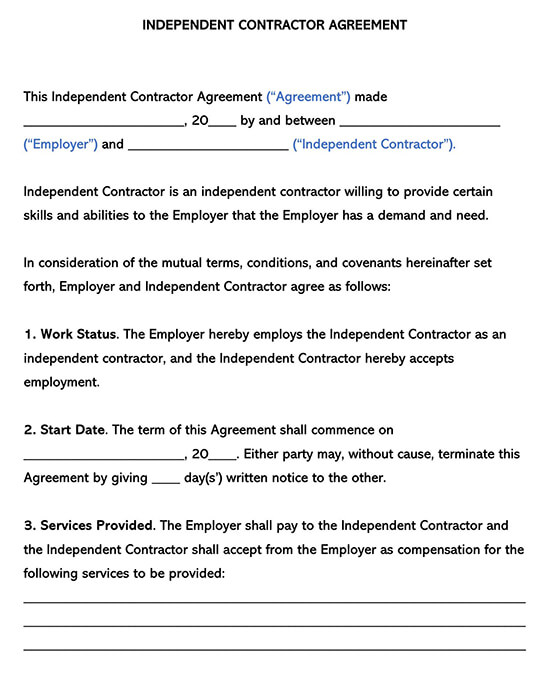

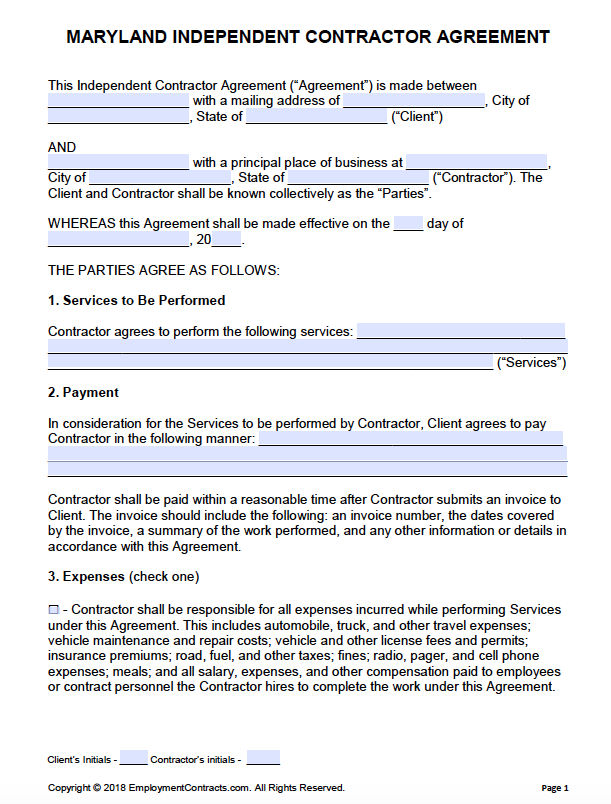

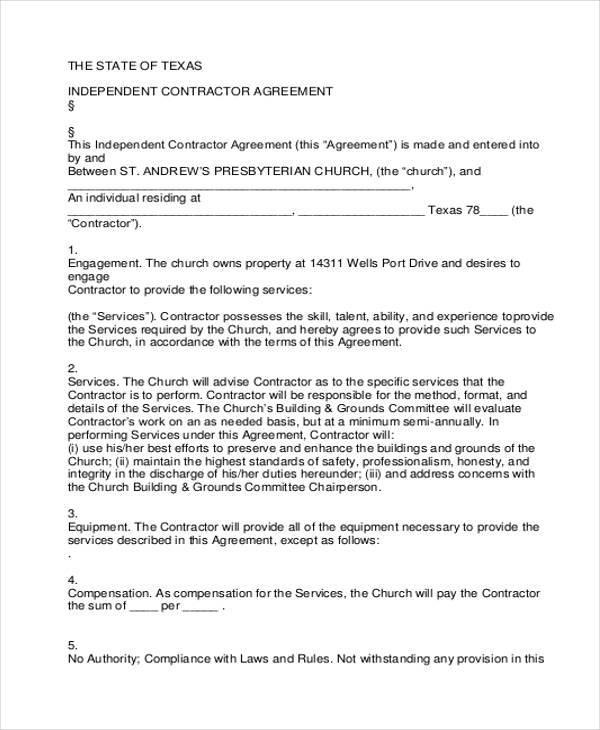

This independent contractor agreement contains the following terms and conditions The company is employing this independent contractor and the independent contractor agrees to accept the employment Both the parties agree that after the first 30 days of the term either party can without cause terminate this agreement by giving 30 days writtenAgreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply) ☐ Contractor has the right toThis Independent Contractor Agreement ("Agreement") made _____, ____ by and between _____ ("Employer") and _____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor

Self Employed Independent Contractor Employment Agreement Contract For Aesthetician In California Us Legal Forms

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Contractor enters into this Agreement as, and shall continue to be, an independent contractor All Services shall be performed only by Contractor and Contractor's employees Under no circumstances shall Contractor, or any of Contractor's employees, look to Company as his/her employer, or as a partner, agent or principal Neither Contractor, nor any of Contractor's employees, shall be entitled to any benefits accordedIndependent Contractor Agreement DeMarseCo Holdings Inc and Daniel H Smith () Independent Contractor Agreement RedEnvelope Inc and John Roberts () Independent Contractor Agreement Western Brands LLC and Ronald Snyder () Independent Contractor Agreement CytRx Corp and Louis J Ignarro () You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Free Printable Independent Contractor Agreement Form Contract Construction Example

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

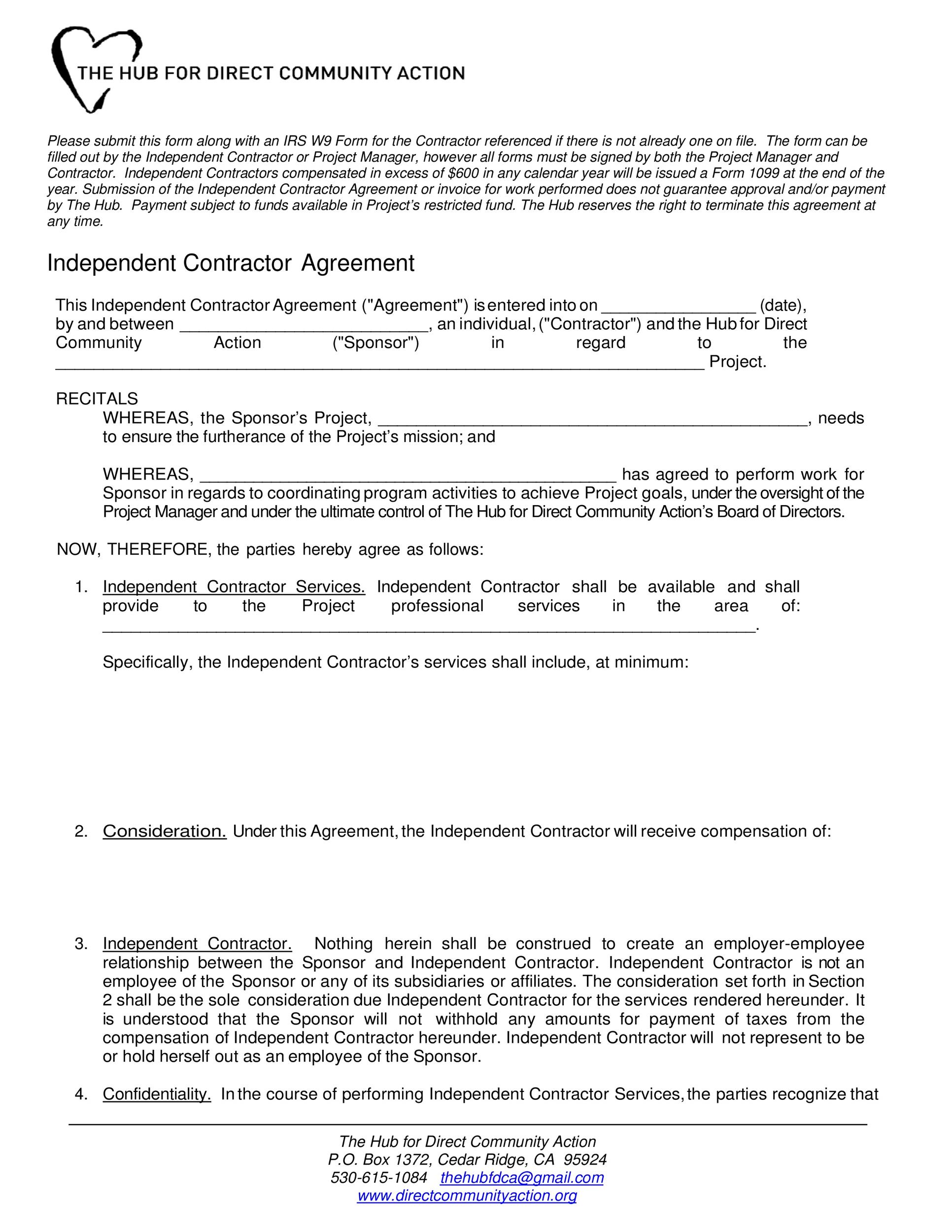

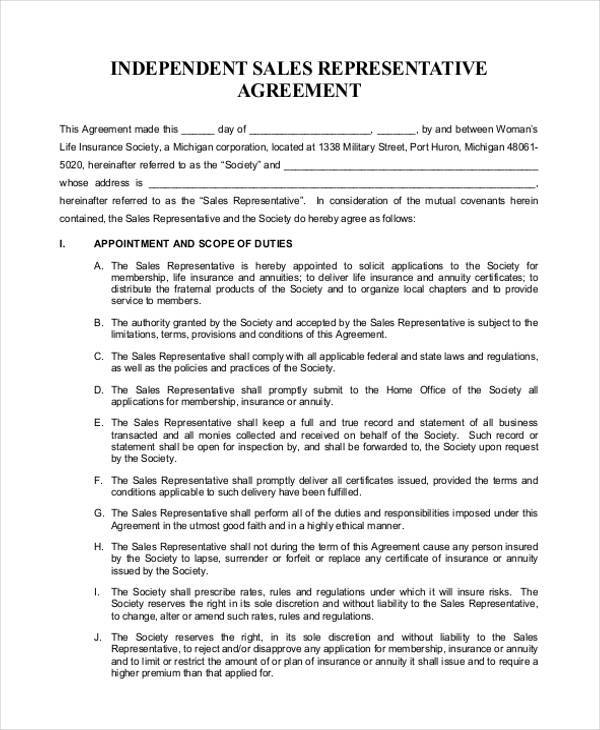

Contractor shall remain responsible for proper completion of this Agreement 9 Independent Contractor Status Contractor is an independent contractor, not Owner's employee Contractor's employees or subcontractors are not Owner's employees Contractor and Owner agree to the following rights consistent with an independent contractor relationship • Contractor has theThis Agreement supersedes all prior independent contractor agreements of any kind, whether written or oral, between the Parties, preceding the date of this Agreement 102 This Agreement may be amended only by written agreement duly executed by an authorized representative of each party (email is acceptable) 103Reliable Trucking, Inc Independent Contractor Agreement 1 Independent Contractor Requirement Checklist The following documents are required to be in our office before we may hire your equipment Please make sure all of the required items are in as soon as possible We will be unable to dispatch you, or release any money owed to you, until we have received this

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

1

The sample independent contractor agreement here makes provision for all simply delete the ones which are not applicable You should also familiarize yourself with the "workforhire" principle where we discuss the rights of both employer and contractor Important Note Visit our main Independent Contractor page for links to guidelines and more free legal forms eg Referral Agreement Independent Contractor Status This is one of the most important parts of your contractor agreement as it clearly defines the worker as an independent contractor, not an employee This section lists the contractor's rights to perform jobs for others unless such services will compete or conflict with their work in your company directly The contract should clearly specify whether the contractor An independent contractor agreement spells out the nature of the work being performed and the price to be paid, but the person soliciting the work cannot control the schedule of the person performing it or how it is done, because an independent contractor is not an employee An Independent contractor is a selfemployed worker The independent contractor

What Is A 1099 Contractor With Pictures

Free Independent Contractor Agreement Template What To Avoid

Independent contractor agreement Download free template & sample Free doc (Word) and pdf independent contractor agreement template suitable for any industry and essential when hiring new employees for your business Independent Contractor Agreement is a written contract that outline the terms of the working arrangement between a contractor and client, including a A truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement Generally speaking, truck drivers are hired to transport goods from one facility to another or from a seller to a buyer A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreement An independent contractor agreement is a document that an employer uses to hire a freelancer for a specific job By extension, it distinguishes the independent contractor from an employee of the business for legal and tax purposes

How To Write An Independent Contractor Agreement Mbo Partners

Freelance Contract Create A Freelance Contract Form Legaltemplates

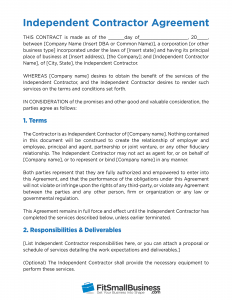

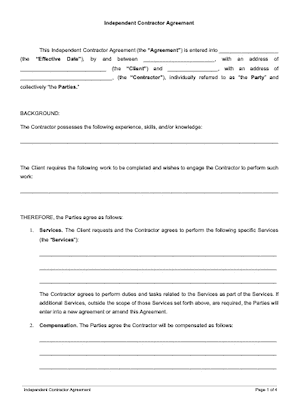

Keep it simple Deal with the right person Identify each party correctly Spell out all of the details Specify payment obligations Agree on circumstances that terminate the contract Agree on a way to resolve disputes What should be included in an independent contractor agreement?This independent contractor agreement is between ("the Company"), an individual a(n) and ("the Contractor"), an individual a(n) The Company is in the business of and wants to engage the Contractor to The Contractor has performed the same or similar activities for others The parties therefore agree as follows 1 ENGAGEMENT;What Is an Independent Contractor Agreement An independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative names One can expect this kind of contract to

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

1099 Form Independent Contractor Agreement

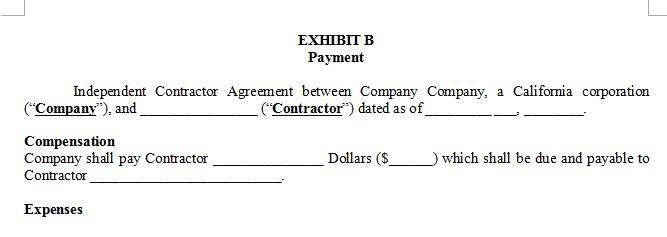

And the payment of all taxes incurred related to or while performing the Services under this Agreement, including all applicable income taxes and, if the Contractor is not a corporation, all applicable selfemployment taxes Upon demand, the Contractor shallReal Estate Confidentiality Agreement;INDEPENDENT CONTRACTOR AGREEMENT NoticesAll notices hereunder shall be in writing and shall be sent by registered mail or certified mail, return receipt requested, postage prepaid and with receipt acknowledged, or by hand (to an officer if the party to be served is a corporation), or by facsimile or by email, all charges prepaid, at the respective addresses set forth below

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

Independent Contractor Agreement Texas Fill Online Printable Fillable Blank Pdffiller

Contractor is an independent individual or entity It is engaged in the business of providing services to third parties of the nature described in the Scope of Work contemplated by Section 11 of this Agreement Client wishes to retain Contractor for such services on the basis set out in this Agreement 1 Services and Fees 11 ServicesOutlines payment details and the length, or term of the contract;Company and Independent contractor agree as follows 1 The Company hereby employs the independent contractor as an independent contractor, and the Independent contractor hereby accepts employment 2 The term of this Agreement shall commence on _____ After the first thirty

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Free Subcontractor Agreement Free To Print Save Download

INDEPENDENT CONTRACTOR AGREEMENT THIS INDEPENDENT CONTRACTOR AGREEMENT (the It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any applicable laws, each Party agrees to You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Independent Contractor The relationship between Contractor and Eastmark is that of an independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way Contractor is obligated to comply with all requirements

1099 Form Independent Contractor Free

50 Free Independent Contractor Agreement Forms Templates

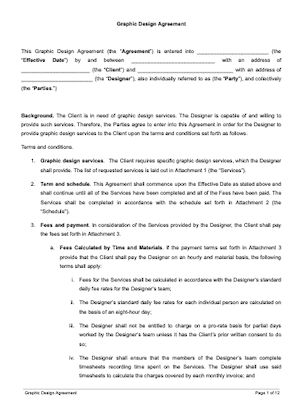

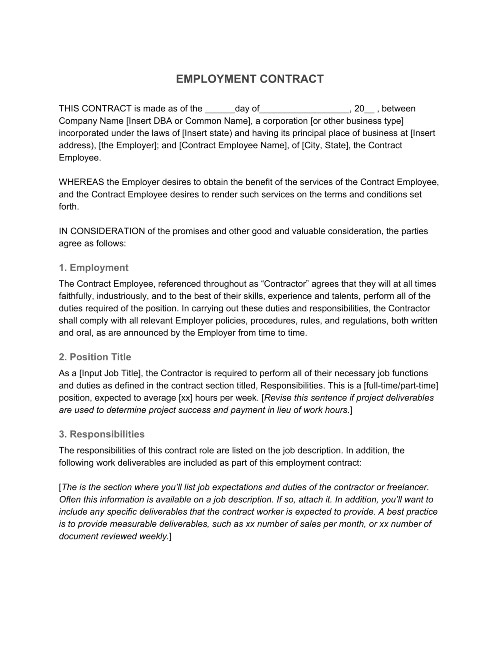

In providing the Services under this Agreement it is expressly agreed that the Contractor is acting as an independent contractor and not as an employee The Contractor and the Client acknowledge that this Agreement does not create a partnership or joint venture between them, and is exclusively a contract for service The Client is not required to pay, or make any contributionsAn Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed;Terms This is the first section of any agreement or contract and states the names and locations of the

Free Independent Contractor Agreement Templates Word Pdf

Use A Nda With Independent Contractor Agreements Everynda

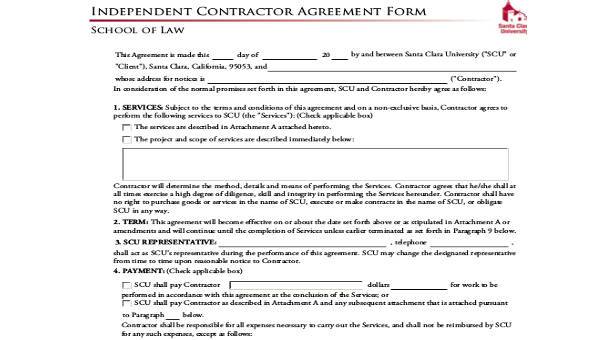

Sample Independent Contractor Agreement This sample agreement should be reviewed and approved by your attorney prior to use This Independent Contractor Agreement ("Agreement") is entered into effective _____ between _____("Ministry") and _____ ("Contractor") In mutual consideration of promises contained herein, the parties agree as follows 1 Services MinistryApartment Lease Agreement Template ;In addition to filing their usual personal tax return, independent contractors must file Form 1099 when they provide their annual declaration This is necessary for selfemployed workers as they must pay an additional 15% tax for their Social Security and Medicare needs

Sample Independent Contractor Agreement Template Free Download Speedy Template

3

1099 form independent contractor agreement 9 Form By wwwsimonsesslercom independent subcontractor agreement template By endlesswebsitetk admin About the Author Search for Recent Posts Free Lease Agreement California;Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and _____, having an address of _____ (hereinafter "CONTRACTOR") WHEREAS, COMPANY wishes to obtain the professional services offered by an independent contractorWhy Should I Hire an Independent Contractor?

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

1099 Form Independent Contractor Agreement

An independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreementSets out other terms of the working relationship, such as ownership of intellectual property;Contractor acknowledges that it will be necessary for Client to disclose certain confidential and proprietary information to Contractor in order for Contractor to perform duties under this Agreement Contractor acknowledges that disclosure to a third party or misuse of this proprietary or confidential information would irreparably harm Client Accordingly, Contractor will not disclose or use, either during or after the term of this Agreement,

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

1099 Form Independent Contractor Agreement Best Of Independent Contractor Agreement Example Simple 16 Independent Models Form Ideas

And Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent ContractorINDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor") Each of ViSalus and Contractor are sometimes referred to individually as aThis INDEPENDENT CONTRACTOR AGREEMENT ("Agreement") is made and entered into as of , by and between ProDex, Inc (the "Company"), with its principal place of business located at 2361 McGaw Ave, Irvine, California , and Mark Murphy ("Independent Contractor"), an individual with his principal place of business located at Clear Haven

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Http Www Giftedtravelnetwork Com Gtn Registration Paperwork Pdf

Make federal or state unemployment compensation contributions on the Contractor's behalf;Sample 1099 Contractor Agreement purchase order Simple Independent Contractor Agreement Contractor Contract Agreement Between Owner And Contractor Template Amp Sample 10 Awesome Collection Of Work For Hire Agreement Templates Construction Contract Template Contractor Agreement Contractor Personal Driver Contract Sample In Contract Template Independent Contractor Contract Sample

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Pdf Independent Contractor Law Of Agency

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

1

Graphic Design Contract Template Signwell Formerly Docsketch

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Template Download Wise

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

1099 Contract Employee Agreement

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

1099 Contract Employee Agreement

Wrongful Termination For 1099 Independent Contractors Workers Compensation Attorney

A 21 Guide To Taxes For Independent Contractors The Blueprint

Employee Versus Independent Contractor The Cpa Journal

/46f6649c-3ea6-4bfb-a67c-8a509a55577e_1.png)

Independent Contractor Agreement

Why Independent Contractor Vs Employee Status Matters Mga

Free Independent Contractor Agreement Templates Word Pdf

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Pdf Word Eforms

10 Must Haves In An Independent Contractor Agreement

Utah County Contractors Contractor Contract Agreement Sample

Independent Contractors

How To Pay Contractors And Freelancers Clockify Blog

Independent Contractor Agreement Template Contract The Legal Paige

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Sample Real Estate Independent Contractor Agreement Brilliant 1099 Contractor Agreement Form Models Form Ideas

Independent Contractor Agreement Template Free Pdf Sample Formswift

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

50 Free Independent Contractor Agreement Forms Templates

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Independent Contractor Agreement Example Word Document Short Form Texas

1099 Form Independent Contractor Agreement

Self Employed Vs Independent Contractor What S The Difference

Free Independent Contractor Agreement Template Download Wise

Free Independent Contractor Agreement Templates Word Pdf

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

1099 Form Independent Contractor Agreement

Free Texas Independent Contractor Agreement Pdf Word

Employment Contract Definition What To Include

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Independent Contractor Billing Template Inspirational 14 Contractor Receipt Templates Doc Pdf Invoice Template Word Invoice Layout Invoice Sample

Independent Contractor Agreement Free Download Signwell Formerly Docsketch

Independent Contractor Agreement Template Lawdistrict

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Independent Contractor Template Contract For Va S The Legal Paige

Create An Independent Contractor Agreement Download Print Pdf Word

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Free Independent Contractor Agreement Free To Print Save Download

Independent Contractor Agreement Template Lawdistrict

Is Client Service Agreement Same As Independent Contractors Agreement In Us Quora

Independent Contractor Contract Template The Contract Shop

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Templates By State With Guide

Free Maryland Independent Contractor Agreement Pdf Word

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Free Florida Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

1099 Contract Employee Agreement

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

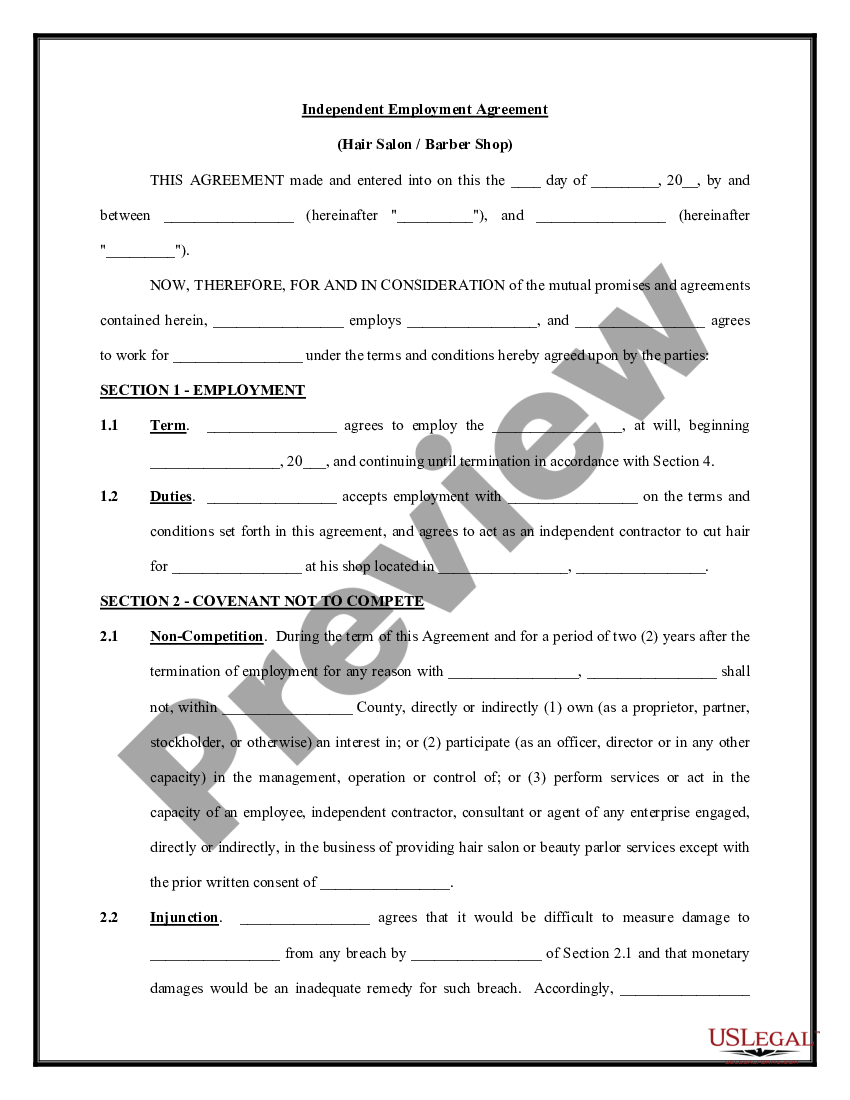

Independent Contractor Defined For Salon Owners This Ugly Beauty Business

Independent Contractor Agreement Pdf Free Download

Independent Contractor Agreement Form 53 Simple Joint Venture Agreement Templates Pdf Doc A Templatelab Answer A Few Simple Questions

Free Independent Contractor Agreement Templates Word Pdf

What Is An Independent Contractor Agreement A Complete Guide

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Free Independent Contractor Agreement For Download

Free Independent Contractor Agreement For Download

3

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Free

Contract With Independent Contractor To Perform Pet Grooming Services Pet Groomer Independent Contractor Agreement Us Legal Forms

0 件のコメント:

コメントを投稿